Business survival requires that you understand your numbers and maintain an accurate business debt schedule.

Running a business requires a business owner to wear many hats and display many skills. They must be involved in areas such as sales, marketing, managing their workforce, managing customer relationships, and leading their business to success through astute financial practices. As described in our book Successfully Navigating the Downturn, there are four pillars to success that all business owners must be sufficient in. They are Management by the Numbers, Reinvention, Sales & Marketing and Debt Workout. These four pillars create a comprehensive approach to building a successful business, which is what we do.

Start Your Free Debt Relief Plan Now

Connect with experts who help businesses get back on track.

No obligation. Available same-day.

Many current business owners have skills in one or more of these areas. Some are great salespeople, some are great at marketing strategies, and others excel in motivating their workforce. However, where many fail to develop fundamental skills is in management by the numbers. They maintain a general understanding of their business performance but often do not review and dissect their financial reporting to determine the best use of their capital.

What this results in is the business owner making poor cash flow decisions, which are often difficult to recover from. What most business owners do is pay the creditors who are the most aggressive in their collection actions first, and not the creditors who are secured or who most benefit the operations of the business. These misallocations can easily get out of control and result in defaulted secured loans, significantly past due vendor debt, missed payments to landlords, etc., non-essential creditors such as credit cards, unsecured lines of credit, and other non-essential debts are made current.

So how do you as a business owner avoid this pitfall? To start, you need to understand your numbers and maintain an accurate business debt schedule. You need to regularly review financial documents such as your profit & loss statement, your accounts receivable schedule, your balance sheet and your cash flow pro forma. Reviewing and understanding these documents will allow you to make a clear capital decision based on business performance, not by which creditor is calling and collecting the hardest. If you need assistance in this area, please contact us regarding our 4 Pillar course that can teach you these skills or seek the advice of an expert with financial management experience.

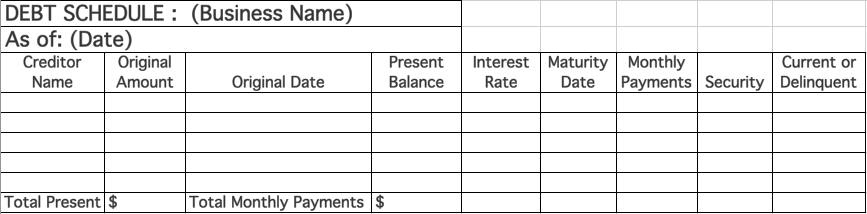

Once confident in your ability to review and understand your numbers, the best starting place is to create a business debt schedule for your business. A business debt schedule is a financial document that lists all creditors of the business. This is not the same thing as an accounts payable schedule, as that report takes into account only short-term unsecured debt, nor is it a balance sheet which does not itemize each debt. You can download a free business debt schedule template like the one shown below:

When completing this business debt schedule, a business owner should begin by listing the business’ secured creditors first. The rule of thumb here is to list the creditors in order of who can do the most damage to the business should the debt be in default, and the creditor began seeking legal remedies to collect. Secured creditors are creditors who filed a lien or UCC-1 against the assets of the business and have rights to liquidate that collateral in the event of default. These creditors should be the first priority when it comes to payment. We suggest listing them in order of date of origin because the creditor with the first lien filing has the most secured rights against your business collateral.

From there you should list any critical vendors or other creditors that could cause business interruption if not paid adequately. These could be key supplier relationships, your landlord, vendors with lien rights, etc. These are creditors whose products and services are not easily replaceable on the open market and could cause an inability for the business to operate smoothly.

The last group of creditors that should be listed are unsecured non-essential creditors. These typically include vendors, credit cards, unsecured lines of credit, and cash advances. These creditors have the smallest recourse against the business and its assets and will not affect the normal flow of business if not paid on time. Vendors in this category can often be replaced with an alternate supplier who can provide the same products and services, often with better payment terms.

Once the schedule is complete, you can now take a look at your cash on hand, and the pay the creditors in order of priority. You can also then project how much revenue will be received in the upcoming weeks and make commitments in good faith to all the creditors who you currently do not have the cash to pay. This will help stem any collection calls and letters you may be receiving as your creditors will know that you are working towards getting them paid. Most importantly, a prioritized business debt schedule allows you to assure your business survival and success by making sure that revenue is not misallocated.

?>&evkey=101218012)