Understanding Factor Rates for MCA Debt vs. Interest Rates and APRs

One of the biggest points of confusion for a business owner seeking working capital is understanding how much their cash advance is actually going to cost them. If you have applied for a home mortgage, auto loan, credit card, commercial property or business loan, you are already familiar with interest rates and Annual Percentage Rates. But certain types of alternative lenders—like invoice factoring and merchant cash advance (MCA) companies—don’t use interest rates; instead, they use what’s known as a factor or buy rate. This can make it impossible to compare apples to apples when exploring your funding options and can make MCA debt a dangerous alternative.

The truth is, factor rates, interest rates and annual percentage rates all have distinct differences, but since the latter two also have many similarities, we’ll start by comparing those.

What is an APR vs. an Interest Rate?

The interest rate is the cost you will pay each year to borrow money. It can be variable or fixed, but it is always expressed as a percentage. It does not reflect fees or any other charges you may have to pay for the loan.

The annual percentage rate (APR) is a broader measure of the cost of your loan because it includes the interest rate plus other costs (such as origination fees, closing fees, documentation fees, and other finance charges), also expressed as a percentage. For this reason, your APR is usually higher than your interest rate.

By simply looking for the lowest monthly payments or the cheapest interest rate, many consumers can get inadvertently trapped in a high-priced business loan. APR is considered the true cost of a loan, so using that number to compare your options is the most transparent way to show how much you’ll be paying your lender back.

But what if you no longer qualify for a bank loan and need an advance that uses a factor rate to calculate your total costs? How does a factor compare to the interest rate you’d pay for a traditional loan?

How Does a Factor Rate Differ From an APR?

While most business owners understand APR, few are familiar with the factor or buy rate associated with cash advances. Expressed as a decimal that generally ranges from 1.1 to 1.5, factor fees are calculated only once using the original loan amount. The lender calculates all interest due and divides it evenly among your scheduled payments.

To determine your total payment, your factor rate is multiplied by the amount you’re borrowing.

Amount Borrowed x Factor Rate=Total Repayment

So, say you’re getting an advance of $10,000 at a factor rate of 1.35 for a 12-month term.

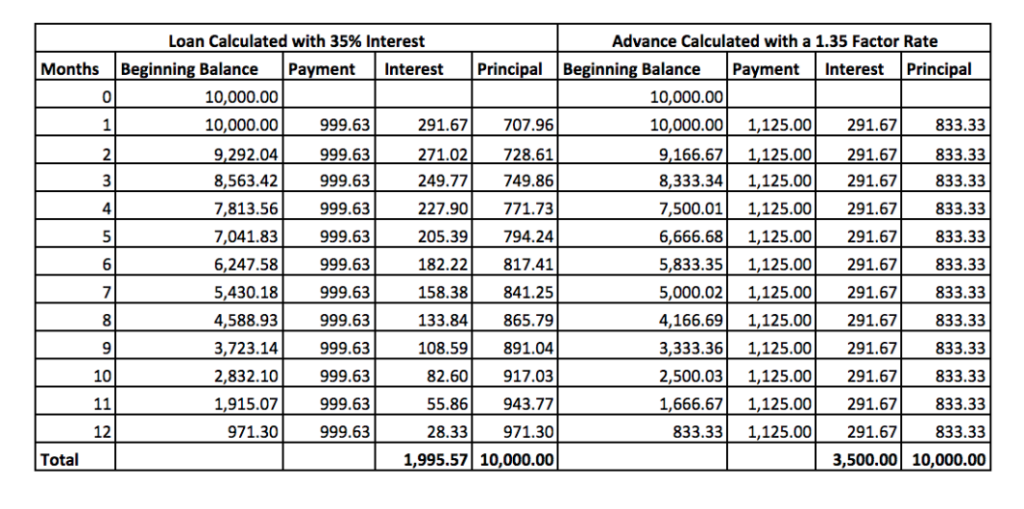

The total amount you’ll need to repay is $13,500 ($10,000 x 1.35 = $13,500). So that $3,500 that you’re paying for the advance will be evenly divided into your payments over the span of 12 months, resulting in a monthly “interest” payment of $291.67.*

*(It should be noted that almost all cash advance companies require daily payments via automatic withdrawal from your bank account, rather than one monthly payment. For our purposes here, however, we’ll use a monthly payback amount to most easily compare factor rate payment schedules to those of interest rates. For more about how MCA companies collect their fees, read MCA Debt Relief: The Ultimate Guide).

Unlike with a factor rate, a loan based on an APR has interest payments that get smaller and smaller over the payback term, since interest accrues on the depreciating principal. This is the most obvious drawback of a borrowing product that calculates the cost of the loan or advance using a factor rate–the monthly (or daily) payment always stays the same. As a result, there is no way to save money by paying off MCA debt early, like you can with a term loan.

So, back to our example above. Because the payback amount of $3,500 is 35% of the $10K borrowed, many people would mistakenly think this advance is the same as a loan with a 35% interest rate. However, due to amortization–the process by which the interest payment decreases in relation to the decreasing principal–a loan calculated with a 35% interest rate would actually result in a payback amount much smaller than $3,500. $1504 lower, to be exact.

As you can see from the left side of the table, the interest payments decrease from $291.67 in the first month to $28.33 in month twelve. Over the course of one year, a term loan with 35% interest results in a total payback amount of $1995.57. So clearly, a factor rate reflecting the same percentage results in MCA debt that comes at a much higher cost.

And that’s not all. Interest rates are calculated on an annual basis. So if the factor rate of 1.35 were, in fact, indicative of a 35% interest rate (and as you now know, it’s not), that would apply to a 12-month payback period. Most MCAs, however, have shorter payback terms. If you acquired the same advance from our example but paid it back in six months, that “interest rate” effectively doubles to 70%. Pay it back in three months, and it’s 140%!

What Does All of This Mean for You?

The bottom line is that it’s undoubtedly in your best interest to choose a borrowing product that is calculated based on interest rates and APRs–if you’re still eligible for one. Most of the time, however, an alternative lending option, such as an invoice factoring arrangement or a merchant cash advance, is the last line of defense for a business owner in a cash flow crisis.

That’s why it’s so important to be clear about what fees you’re paying and vigilant about a plan to support an MCA debt schedule while maintaining day-to-day operations. If you’re unsure about the best path for your business, Second Wind Consultants can help. Set up a free consultation today to learn more about how to get out from under your unsupportable debt.